Introduction: Understanding Home Insurance Basics

When it comes to protecting your most significant investment, your home, insurance is your safety net. Home insurance not only offers financial protection but also peace of mind. But what should you insure in your home? In this comprehensive guide, we will explore the ins and outs of home insurance, highlighting the essentials you should consider insuring in your home.

The Purpose of Home Insurance

Home insurance serves two primary purposes: to protect your physical home and to safeguard your personal belongings within it. Understanding these basics will help you make informed decisions about what to insure in your home.

Why Insure: The Importance of Protecting Your Assets

Before diving into the specifics of what to insure in your home, let’s delve into why home insurance is crucial. Here are some compelling reasons:

1. Financial Security

Home insurance provides financial security by covering repair or replacement costs in case of damage to your property. This includes damage from natural disasters, fires, vandalism, and more.

2. Mortgage Requirements

Most mortgage lenders require you to have home insurance before granting a loan. It’s a way for them to ensure their investment is protected. Failure to comply with this requirement could jeopardise your mortgage.

3. Liability Protection

Home insurance also offers liability protection. If someone is injured on your property your insurance can cover legal and medical expenses.

Everyday Essentials: Items We Often Overlook

Now that we understand the importance of home insurance, let’s explore what to insure in your home. Often, we tend to overlook everyday essentials that are easy to forget but important to protect.

1. Appliances

Your kitchen appliances, washer, and dryer may not seem glamorous, but they are essential to daily life. It is important to include the cost of replacing these items when setting a value for your contents in your home.

2. Furniture

Your couch, dining table, and bedroom sets are substantial investments. Insuring them ensures you can replace them if they are damaged or stolen.

3. Electronics

From your television to your laptop and gaming console, electronics are integral to modern living. Home insurance can cover these items in case of theft or damage.

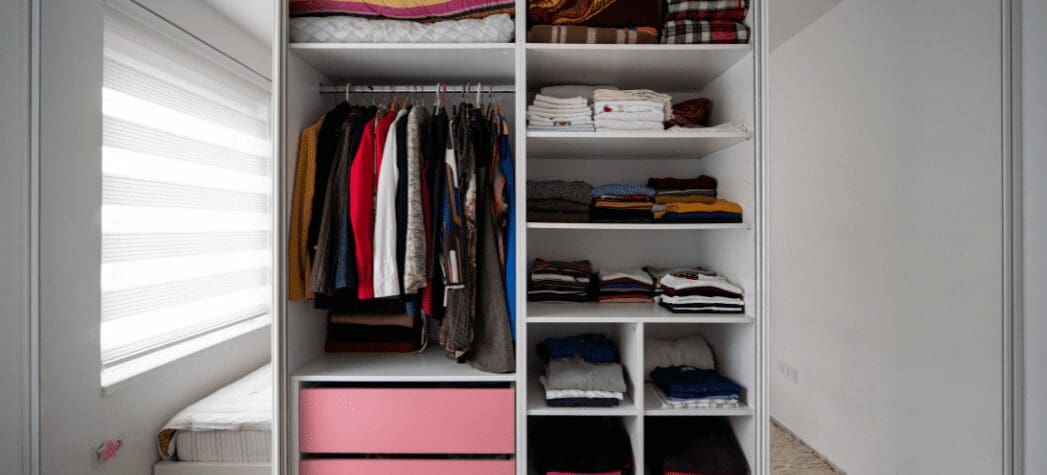

4. Clothing and Personal Belongings

While not typically high in value individually, the cumulative cost of your clothing and personal belongings can be substantial. Insure these items to avoid a significant financial loss in the event of a disaster.

Valuable Keepsakes: Insuring Priceless Treasures

Beyond everyday items, many homeowners have valuable keepsakes and collectables that hold sentimental or monetary value. These should be included in what you insure in your home with content insurance coverage.

1. Jewellery

Engagement rings, heirloom necklaces, and other valuable jewellery items should be appraised and insured separately to ensure adequate coverage.

2. Artwork

Whether you have original paintings, sculptures, or vintage posters, consider insuring your art collection. Their value can be appreciated significantly over time.

3. Antiques

Antique furniture, china, and other collectables should also be insured separately if their value exceeds the limits of your standard policy.

4. Rare Collectibles

If you collect rare valuable items, ensure they are adequately insured to protect your investment.

Protecting Structural Elements: Flooring and Built-in Fixtures

Home insurance isn’t just about your personal belongings; it also covers the structure itself. Here are some structural elements to consider insuring:

1. Flooring

Many homeowners overlook the cost of replacing or repairing damaged flooring. Whether it’s hardwood, tile, or carpet, ensure your insurance policy includes coverage for flooring.

2. Built-in Fixtures

Built-in fixtures such as kitchen cabinets and bathroom vanities are part of your home’s structure. Insure them to avoid significant expenses if they need replacement or repair.

Home Renovations and Additions

If you’ve invested in home renovations or additions, don’t forget to update your insurance coverage accordingly. These improvements add value to your home, and you should insure them to protect your investment fully.

External Structures (Sheds, Garages, and Gazebos)

Your home insurance policy can often extend coverage to external structures on your property. This includes sheds, garages, gazebos, and more. However, it’s essential to review your policy and ensure these structures are adequately protected.

Liabilities and Unexpected Scenarios: In-home Accidents and Guest Injuries

Lastly, your home insurance policy also includes liability coverage. This protects you in case of accidents or injuries that occur on your property. Here are some scenarios to consider:

1. In-home Accidents

If someone slips and falls in your home, your liability coverage can help cover medical expenses and legal fees.

2. Guest Injuries

When hosting gatherings or parties, accidents can happen. Liability coverage can protect you if a guest injures themselves on your property.

3. Damage to Others’ Property

If your actions cause damage to someone else’s property, such as a tree falling on a neighbour’s car, your liability coverage can come to the rescue.

Knowing what to insure in your home is essential for protecting your assets and achieving peace of mind. Beyond the basics, it’s crucial to consider valuable keepsakes, structural elements, external structures, and liability coverage. Here at askacorn.ie/home-insurance/ we can provide all the cover you need for your home and the valuable contents inside. If you need home insurance we’ll find the best price for you here at Acorn Insurance and try to help keep your cost down by finding you the best home insurance quote. Get a quick quote or contact us, by giving us a call at 0818 800222 or request a call back. Regularly review and update your home insurance policy to ensure it adequately reflects the value of your possessions and property. By doing so, you’ll be well-prepared for unexpected events and can confidently protect your home and everything within it.