Retirement Blindspot:

- 1 in 3 Irish Women Have No Pension Savings – And 1 in 4 Men

- 45% of over 55s have either less than €10K retirement savings or none at all

- Women Over 55 Have €62,000 Less in Pension Savings Than Men Their Age

- Just 15% of Women Have Pension Pots Over €100,000, Compared to 1 in 3 Men

- Ticking Time Bomb: Half of Over-55s Have Less Than €10K Saved for Retirement

The average Irish woman’s pension pot is 40% less than their male counterpart’s, according to new research from Ask Acorn. The survey of 1000 adults nationwide commissioned by financial services intermediary Ask Acorn1 , with a nationwide network of over 100 advisors, found that the average pension pot of an Irish man is €102,017 for males but only €60,562 for females. This means that Irish women have on average saved €41,455 less into their pension pots than men, indicating a gender pension gap of 40%.

Headline findings from the Ask Acorn survey reveal that:

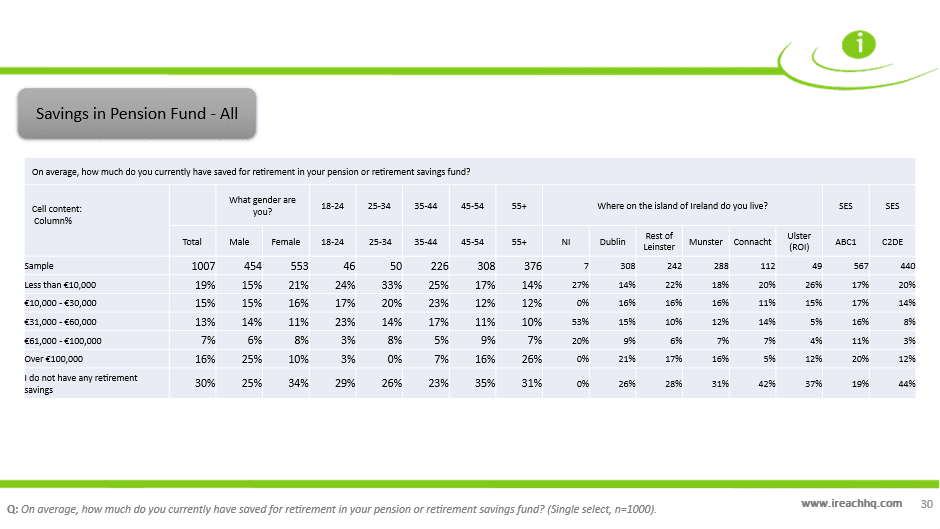

- Overall, three in ten (30%) Irish adults have no retirement savings – however that rises to one in three women (34%) and falls to one in four men (25%). (Appendix Table 2)

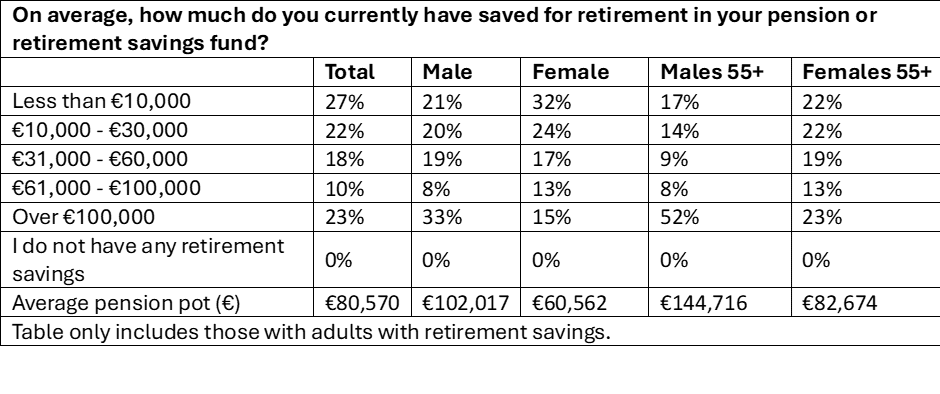

- The average pension pot built up by males aged 55 plus (those in or near retirement) is €144,716. For females, the amount falls drastically to €82,674. On average, Irish women close to retirement have €62,042 less in their pensions than their male peers. Indicating a gender pension gap of almost 43% for those in or near retirement (Appendix Table 1).

- Overall, across the various age groups, the average Irish person with retirement savings has built up a pension pot of €80,570.

- Looking specifically at those with retirement savings, far more men than women have pension pots worth more than €100,000: 33% of men said they have pension pots of €100,000 or more but only 15% of women said the same (Appendix Table 1).

- More than half of women with retirement savings (56%) have at most €30,000, with many holding substantially less. By comparison, just 41% of men have savings at or below this level (Appendix Table 1).

- Commenting on the survey findings, Keith Butler, CEO of Ask Acorn, said:

Commenting on the survey findings, Keith Butler, CEO of Ask Acorn, said:

“Despite the progress on gender equality in recent years, including female participation in the workforce reaching all-time highs2 , women are still falling well behind men when it comes to their pension pots. The research points to a staggering 40% difference between what a woman in Ireland has in her pension, and what a man has. And that’s if they have a pension at all – the study shows that far fewer women than men actually have any retirement savings. Given that women in Ireland typically live longer than men, and that there has been a substantial increase in recent years in the number of female retirees, the gender pension gap is hugely concerning.

Women have long faced challenges in building their pension savings and these challenges are well documented. Women often earn less than, and as a result, don’t have as much to save into their pension as their male counterparts3 . Wages in some of the job sectors traditionally dominated by women are often low4 . In addition, mothers often take time out of the workforce, or move to shorter working weeks, to look after children. Women are also three times as likely as men to work part-time5 .

Is imperative that that the gender pension gap is addressed, otherwise many women could struggle to make ends meet in retirement, finding it difficult to fund medical care when they most need it, or could simply find their lifestyle in retirement is not as comfortable as they had hoped. The reasons eating into a woman’s ability to save for a pension need to be tackled and addressed and more needs to be done to encourage women to save adequately for their pension.”

Socio-economic and geographic pension gaps

The Ask Acorn survey also revealed stark socio-economic and geographic divides when it comes to pension savings:

- More than two fifths (44%) of working class6 people don’t have retirement savings, compared to less than one-fifth (19%) of the middle-class7 (Appendix Table 2).

- Residents of Connacht are the least financially prepared for retirement, with more than four in ten (42%) having no retirement savings. This compares to 26% of Dubliners, 28% of those living in the rest of Leinster and 31% of Munster residents (Appendix Table 2).

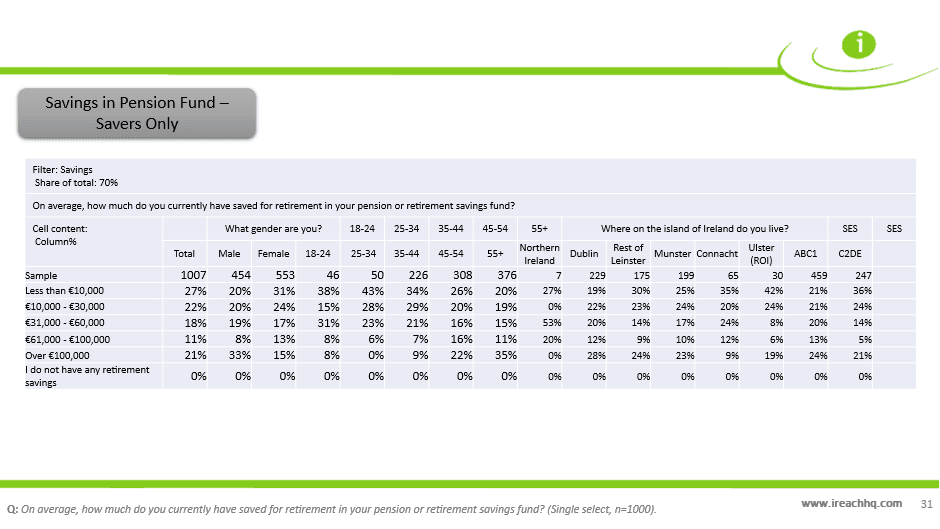

- People in Dublin have the biggest pension pots. Three in ten (28%) Dubliners with retirement savings have built up pension funds worth more than €100,000. This compares to less than one in ten (9%) Connacht residents.

- 45% of the respondents over 55s had either less than 10,000 in retirement savings – or had none at all.

Mr Butler added:

“Given their proximity to retirement, it is very worrying just how many people have practically nothing to fall back on in terms of pension savings. The risk of poverty in retirement has unfortunately increased in recent years, particularly for those aged 65 and over who are living alone8 . Rising living costs and the gender pension gap are contributing to this.

It is also concerning that our research has found that 64% of the working class have no retirement savings in place or have less than €10,000 in pension savings, and across the board, regardless of socio-economic standing, there are 49% of people in the same boat.

For those without any retirement savings, their only source of income in retirement could be the State pension – if they qualify for it. At a maximum of €289.30 a week, people who are solely reliant on the State pension could struggle to make ends meet, particularly if they are carrying any large financial obligations into retirement, such as a mortgage or rent.

It is imperative that people across all walks of life take a long hard look at their pension savings so that they know exactly what kind of lifestyle they can expect from their pension pot in retirement – if they have one. In the event that pension savings are falling short or have not even begun, it is crucial that people take steps to rectify this before it is too late. More needs to be also done by the Government to educate and empower people around their pension savings.”

Appendix

Table 1

Table 2

Table 3

Notes

- Conducted by iReach ↩︎

- As per CSO Labour Force Survey Quarter 3 2024 ↩︎

- See PwC 2024 Gender Pay Gap report ↩︎

- See caring earnings in Figure 3.4 in and CSO Structure of Earnings Survey 2022 ↩︎

- Females, at 23%, are much more likely than males (7%) to work part-time – see ‘Profile 7 – Employment, Occupations and Commuting’ in Census 2022 ↩︎

- Class C2DE ↩︎

- Class ABC1 ↩︎

- As per CSO Survey on Income and Living Conditions (SILC) 2024 ↩︎